Tag Archives for Google

Supercharge your Android Wear smartwatch with these IFTTT recipes

Nexus 7 Trade-Ins Suggest Lots Of Upgraders To New Model, Little To No Interest From The iPad Crowd

The new Google Nexus 7 is a big improvement over the original with a bunch of additions like LTE and a super high-resolution display – the best in tablets, in fact. And that’s driving a lot of first generation device owners to trade in their old Nexus 7, according to gadget buy-back site Gazelle. There was a 333 percent spike in the number of Nexus 7 tablets traded in compared to the same day last week, for example.

Between Tuesday and Wednesday, that spike was even higher – a 442 percent jump in Nexus 7 tablets happened between the day before Google’s official unveiling of the new model, and the day of. The Nexus 7 trade-in activity spiked so high that it made up nearly a quarter of all trade-ins for non-iPad tablets since the site began accepting them earlier this year.

Wednesday, the day Google made its announcement, was also the biggest Nexus 7 trade-in day at Gazelle to date, beating the next biggest day by 380 percent. That previous record was set when the new Nexus 7 leaked on July 17, which clearly prompted early adopters to take advantage of a small head start ahead of the big reveal.

The news means that Google Nexus 7 owners are probably happy with their devices and eager to grab new ones, by trading in their last-gen devices to fund their purchases, but there’s another stat that tells another side of the story: Gazelle saw no appreciable increase in iPad trade-ins on the new Nexus 7 launch day. That means Google probably isn’t luring iPad owners away from the iOS fold.

It’s probably not surprising to longtime tablet space watchers that the new Nexus 7, with all its apparent merit, isn’t an iPad killer. The Apple camp seems happy where they are, but the tablet market has plenty of room to grow; we’ll see if Google can expand outward, or if it’s mostly eating its own Nexus tail with this new model.

Google’s Chromecast No Longer Comes With Free Netflix Because Demand Got Too Nuts

In what is a solid example of the best sort of problem to have, Google’s just-announced Chromecast video streaming dongle is already proving too damned popular for its own good.

At yesterday’s debut, Google announced that buyers of the $35 device would also be getting three free months of Netflix service with their purchase. Just 24 hours later, that deal is off. Sad trombone.

Why? “Overwhelming demand”, says the Googles. Someone had to pay for that service in the end, after all – so if Google can’t even keep these things on the shelves, they can probably get away with nippin’ out the Netflix perks.

With that said, those three free months might have been a non-trivial part of why the device was getting snatched up so quick. A streaming-only Netflix plan costs $8 per month ($24 for three months) and Google’s Netflix deal applied even if you were already a Netflix subscriber. For current Netflix customers (or for anyone who would be down to sign up for 3 months of free service) it brought the effective cost of the (already crazy cheap) Chromecast down to eleven dollars. At that point, there’s not even a decision to make.

If you snatched up a Chromecast before Google killed the deal: don’t worry. The LA Times got confirmation that Google will honor the promotion for all the early buyers, though it’s not entirely clear where they plan to draw the line.

Update: Amazon updated their product page to say they’ll honor the deal for anyone who ordered before 5:31 p.m. yesterday. Sucks for you, 5:32 ers!

[Disclosure: Google loaned me a Chromecast for the week so I can tinker with it. It’s going back (read: I’m not keeping it), but I’d rather disclose too much than disclose too little. Review should be up this weekend.]

Android 4.3 Includes Hidden App Permissions Manager That Could Bolster Privacy & Security

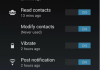

As expected, Google officially confirmed Android 4.3 at its event on Wednesday with Android chief Sundar Pichai. Among the new features/improvements in the update are a redesigned camera interface, Bluetooth Low Energy support, performance improvements such as smoother animations, and multi-user restricted profiles. But there’s apparently something else that Google didn’t talk about. Android Police has unearthed a hidden app permissions manager that allows users to selectively disable certain permissions for apps.

The feature is apparently called App Ops, and lets users toggle app permissions – such as location and the ability to post notifications – on and off for individual apps. Android Police notes that a developer has already created an app (available here on Google Play if you have Android 4.3 installed) that foregrounds App Ops, and has been having a play around with it.

The basic idea of the feature is apparently to give Android users more flexibility over what apps can and can’t do, allowing them to choke off battery draining features, say, or rein in irritating notification behaviour. If Google does decide to fully implement App Ops as a user-facing feature, there are potential big benefits here, from a security and privacy point of view, being as it could give users fine-grained control over what each app can do.

Apps they might otherwise have been tentative about installing could presumably be fine-tuned to fit their tastes now – which may also have some developer benefits, if it helps drive overall installs.

However Android Police notes that while App Ops does work, the feature is clearly not ready for the prime time yet – while testing it with the Facebook app they found certain app permissions only appeared in the permissions list once the app had made use of them, for example. Such messiness likely explains why Google has hidden App Ops and wasn’t ready to talk about it on Wednesday. We’ve reached out to Mountain View to ask for its plans for the feature and will update this story with any response.

Another possible complication attached to the feature is user confusion if a user doesn’t realise that the reason a particular in-app feature isn’t working is because it has been toggled off at source. A similar problem can occur on some Android devices with the quick settings in the notification tray overriding the main setting for things like silencing sounds/ringtones. Add in per app permissions and the potential user confusion is enormous. Android Police notes that one way for Google to get round could be to include some kind of system notifications warning users when App Ops is limiting app permissions. Although that would get old pretty quick if users get nagged every time they open an app with restricted permissions.

It is also possible that the App Ops feature has been created by Google to power the multi-user restricted profiles feature it did announced on Wednesday, which allows for parental controls to be implemented on Android devices.

The Android platform also has the most malware activity associated with it of all the mobile platforms, so the App Ops feature could be something Google is lining up to help bolster security concerns attached to Android. For instance, the feature could allow users to block apps from making calls – to kill off premium rate phone call/SMS malware – or trace which apps have been making calls to identify rogue software.

Comcast and Verizon Decide They Don’t Need to Compete With Apple, Google and Everyone Else, After All

Last year, when Verizon Wireless and Comcast were trying to get lawmakers to sign off on a giant wireless spectrum sale/noncompete pact, the two companies also said they were going to create a technology/R&D joint venture. It was supposed to come up with really cool tech products that consumers would love.

That JV is now dead. Verizon announced its demise today during the company’s earnings call, but said the partnership actually ended in late August.

The news here is that the most important part of the Comcast/Verizon deal hasn’t changed. Verizon still owns valuable spectrum it purchased from Comcast, and the two companies are still agreeing not to compete – or at least not to compete very vigorously.

It’s not surprising that Comcast and Verizon have concluded that their JV didn’t make sense. Most JVs don’t. And if there is an example of two companies at the scale of Comcast and Verizon successfully working together to create cool consumer tech, I’d love to hear about it.

For the record, though, the two companies didn’t seem to have those doubts back in March 2012. Back then, when the companies were still trying to get federal approval for the deal, they were pointing to the JV as a big win for consumers.

Here’s what Comcast executive vice president David Cohen told a Senate subcommittee back then:

“By enhancing the Cable Companies’ and Verizon Wireless’s own products and services, the Joint Venture will compete with similar solutions that AT&T, Dish Network, Google, Apple, Microsoft, and others already have introduced into the marketplace. This, in turn, will spur other companies to respond, perpetuating a cycle of competitive investment and innovation.”

And here’s what Verizon is saying, via a spokesperson, today:

“The joint venture was formed to bring innovation to the marketplace and enhance the customer experience through technology that integrated wireline and wireless products and services. Evolving technology and market changes since the joint venture was formed have led all parties to conclude that a joint venture, per se, is no longer needed to deliver innovative services to customers. Verizon Wireless and the cable companies will continue to explore ways to collaborate on technology in the future. Each company remains committed to bringing innovation to its customers and will continue to find ways to optimize the user experience for each company’s products.”

If you’re a skeptical person, you might think that Comcast and Verizon were overselling the benefits of the JV from the start. You might think that they never really thought they could successfully compete with the likes of Apple and Google, but were holding out the idea because consumer groups were unhappy with the other parts of their pact, which seemed likely to reduce competition between the two companies.

On the other hand, both Comcast and Verizon did assign people to work on this stuff together, and they did do some work. Comcast, for instance, points to the Xfinity TV Player app, which lets you download movies and TV shows to your iPad and iPhone and take them with you, as an example of the joint venture’s output. [Update: Strike that. A Comcast rep tells us we had bad information: The app was made in-house, not via the JV.]

So, if you were a different kind of skeptical person, you might think that Comcast and Verizon really did think they could successfully compete with the likes of Apple and Google. And the fact that it only took them 17 months to realize they were wrong – and pull the plug – is a good thing.

(Image courtesy of Shutterstock/Carlos Caetano)

Google Will Let Anyone in the U.S. Buy Google Glass on April 15

Even if you don’t have a Google Glass Explorer invitation, you can soon get your hands on Google’s wearable computer. On Thursday, the company announced a limited promotion on April 15 that opens the doors to anyone in the U.S. to become an Explorer and get a pair of Google Glass with a free frame or shade. This news followed a Verge report that Google was considering such a promotion. Does this say anything about Google Glass in the consumer market? Perhaps. The company has steadily increased availability of Glass Explorer invites over the prior year, meaning that they’re less exclusive than they were prior. Some Google Play Music All Access subscribers, for example, could purchase Glass starting in December. At $1,500, these aren’t an impulse purchase, so I’m wondering if maybe nearly everyone who wants Glass at that price already has the product.

Read the full story at Giga OM, and the original report at The Verge.

iPad iRobot Google Android 1.6

iPad iRobot Google Android 1.6.

About Those Google+ User Numbers …

Since its inception, it has been tough to tell just how well Google’s social network, Google+, is doing. Every time Google+ releases a new set of user number statistics, their accuracy and methods are almost immediately called into question.

According to information released on Thursday, it seems that skepticism was well warranted.

Take Amir Efrati’s Thursday morning story on Google+, which called into question the 300 million active, “in the stream” user visits Google+ recently claimed it received each month.

As Efrati wrote, citing anonymous sources, and Google confirmed to AllThingsD, the “stream” is more broadly defined than one would think. It also means clicking on the little red bell or share icons you see across all of Google’s properties.

Quoth Google, in a statement to AllThingsD:

“Yes, clicking on the notifications bell does count in our monthly actives metric for the Stream. If you click anywhere which leads to the Stream being loaded and displayed, we count you as viewing the Stream. The Stream is rendered on mobile (Android and iOS), on the Web at plus.google.com, and when you click and open a notification view of the Stream on desktop properties.”

To be fair to Google+, yes, you can still reach and use Google+ from all other Google sites. Click the bell when you’re in your Gmail account screen and you’ll indeed be presented with a small, stream-like view of Google+ content. It’s possible that people are sharing from there.

And what’s more, competitors like Facebook also define monthly active users fairly broadly. The numbers include people who use third-party website widgets to share – the “Like” or “tweet” buttons you’ll see on sites like ours, for instance.

The problem is, as Google presents it, we can’t tell if users actually intend to use and share on Google+, or if they’re just clicking on the notifications bell to get rid of it – glaring red and bright against the plain white and gray background of Google’s properties.

So this leaves us, the critics and skeptics, back at a bit of a loss. Perhaps there are a significant number of people actively using and sharing on Google+ from other Google-owned sites.

Or perhaps it’s as dead as lots of people like to joke it is.

We just don’t know. And until Google decides to break down specifically how and from where people are visiting “the stream,” I doubt we’ll ever really have a notion of the network’s health.

Could Google or Tencent Beat Facebook to Buying Snapchat?

Right now, Snapchat is having its “belle of the ball” moment.

The mobile messaging service – which lets users exchange photos and video that disappear after a few seconds – is being courted by Facebook. It has long been an app that CEO Mark Zuckerberg lusted after.

Thursday afternoon brought another turn of the screw. Valleywag reported that Google could also possibly be considering taking a run at Snapchat, matching Facebook’s $3 billion to $3.5 billion offer. Google and Facebook aren’t commenting, but sources said that Google has indeed expressed some interest in a deal. Tencent, the Chinese consumer Internet company, has also been eyeballing the company, according to sources.

I don’t know Snapchat’s fate, and from what I’ve been told, Snapchat CEO Evan Spiegel himself is unsure of it. But it got me thinking – whether they’re in the running or not, which companies are most likely to go after the fast-growing Snapchat?

Let’s go down the list.

Facebook:

Zuckerberg wants Snapchat bad. So bad, in fact, that he tried – and failed – to clone the app outright. Sources familiar with the matter have described the Facebook CEO as “obsessed” with Snapchat and the idea of ephemeral messaging. They told AllThingsD that he has made multiple offers to acquire the company, some for more than the $1 billion he paid for Instagram last year.

Likelihood: Very High

Google:

Google may have Google+, but it knows it can’t hold a candle to Facebook or even Twitter when it comes to social mobile apps. Buying Snapchat could give Google immediate overnight relevance in social, while simultaneously dealing a blow to Facebook. Not to mention that $3 billion is a pittance for the highly profitable company to spend on an acquisition.

Likelihood: High

Tencent:

This is a good fit. Spiegel has described Tencent as a “role model” for Snapchat in terms of revenue models – potentially alluding to in-app purchasing possibilities for the startup.

And Tencent is indeed interested – if not in a full acquisition, then at the very least in a large strategic investment.

Likelihood: Very High

Yahoo:

A dark horse, and at this point not an entrant as far as I’ve heard. Still, CEO Marissa Mayer has the cash to make the deal, and is no stranger to acquisitions. Plus, an acquisition of Snapchat could help to both bolster Yahoo’s mobile efforts – which are lacking – and burnish its less-than-cool image – sort of like buying Tumblr did.

Still, there’s no evidence to my knowledge that Yahoo has approached Spiegel or Snapchat about a potential acquisition.

Likelihood: Unlikely

Twitter:

After long considering killing off its direct-messaging feature entirely, Twitter woke up last year and figured out that people actually love sending private messages. Another satellite app acquisition – similar to the one it did with Vine – could make sense.

Problem is, the figures being thrown around for Snapchat now are way out of Twitter’s price range. They’re nearly double the amount the company just raised in its initial public offering. At this point, Snapchat is far too rich for Twitter’s blood.

Likelihood: Not at all likely

A caveat to many of the past week’s stories on this topic: It’s possible – if not likely – that the escalating prices and number of companies involved is largely due to jockeying from Snapchat insiders who stand to make hundreds of millions on the deal. Read each new report with that in mind.

Another thing to remember: Spiegel intends to raise yet another round of funding for his company at a hefty valuation. If another round goes through, there will likely be a secondary component to it, in which Spiegel and co-founder Bobby Murphy could sell some of their own shares and cash out. That means the two could still continue to go for broke and build out their own company rather than sell to the highest bidder, while having the insurance of already having taken some money off the table. And according to multiple people close to Snapchat, Spiegel and Murphy very much want to build out the startup into a full-fledged company.

Bottom line: If Snapchat keeps growing – and sources said that is indeed the case – Spiegel isn’t under the gun to make a decision today. If all goes well, his acquisition offers – and the high prices they command – likely won’t disappear.