Facebook Accidentally Sent Advertisers Receipts And Data For Other People’s Ads

iCloak Stik Aims To Put Robust Online Privacy In The Hands Of The Many, Not The Few

Google’s Smarty Pins Lets You Test Your Geography Knowledge

eBay-Owned E-Commerce Platform Magento Shuts Down Services Aimed At Smaller Retailers

Bonobos Raises Another $55 Million To Expand Its Online-Offline Shopping Experience

Supercharge your Android Wear smartwatch with these IFTTT recipes

You can now buy Facebook game upgrades directly from your News Feed

Study: Apps and Content Startups Miss Out Because Affiliate Model Is Broken

Skimlinks, the platform which gives publishers greater control over affiliate links and content monetization, releases some major research today which could well concentrate the minds of online “publishers”, and that includes apps, startups and bloggers.

It’s white paper reveals that while editorial or social websites can point a user towards a product they might go on to buy, publishers rarely receive the financial reward for doing so because of problems with the “Last Click” attribution model used in affiliate marketing. Now, while the study is clearly a ploy to get apps and content publishers to run their affiliate programs through Skimlinks rather than through traditional affiliate platforms, the research itself does bear examination.

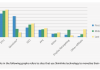

The study found that content sites were the first place users read about a product 27% of the time, and were in the first quarter of the user’s path to purchase 36% of the time. And when a user started their journey to a purchase with a content site, she or he was a new customer 55% of the time. However, content sites were the Last Click only 6% of the time and 94% of the time, the content affiliate was NOT awarded the sale. Plus, 65% of the time when a content site is the first click in a purchase journey, sparking purchase intent, another channel is the last click, taking all the credit for the sale.

They also found that content sites drove nearly 30% more new customers to brand sites than the average of all other channels. In addition, when consumers started reading about a product on a content site their desire to purchase grew over time: in this case, 9% of the sales would occur within one hour, 16% within 24 hours and 31% happened within 3 days.

In other words, if online marketers shifted their affiliate strategy away from the Last Click attribution model towards online publishers, apps and social sites, they’d basically get faster and more robust sales.

This would be music to the ears of many social and content sites.

Alicia Navarro, CEO and co-founder of Skimlinks says: “The general view is that better attribution is required – that distributes the cost-per-acquisition across multiple parties responsible for creating and driving purchase intent. By only remunerating the last-click publisher, you create the wrong incentives, and end up with a ton of low-value deal/coupon sites, rather than rich apps and content, who have less incentive to link out to merchants because they don’t get paid for top-of-funnel activity via affiliate marketing.”

Ryan Jones of Shop Direct, where the study was based, points out that it’s a two-way street: “Retailers are probably missing out on exposure as commercially savvy content sites tend to promote the brands they earn more from.”

For the research Skimlinks analyzed data provided by Shop Direct’s ecommerce site, Very.co.uk, which spanned all orders between July and November 2012 that included a click from a Skimlinks content site.

Skimlinks clients include Conde Nast, Gawker, AOL Europe, WordPress, Hearst Digital, Haymarket Consumer Media, Telegraph Media Group, among others.

Skimlinks’ main competitors are the Google-backed VigLink and the seed-backed startup Yieldkit. This year it completed an undisclosed growth financing round led by Greycroft Partners and others.

Dorm Room Fund-Backed Skillbridge Is A Freelance Marketplace For High-End Professional Services

A startup called Skillbridge is trying to create a new kind of marketplace for freelance work – not for the programming and writing jobs that you’d find on a site like Elance, but for strategy, finance, marketing and other professional services.

The company is announcing today that it has been backed by First Round Capital’s Dorm Room Fund, the firm’s student-run investment arm that offers mentorship and $20,000 in funding to each company. (Skillbridge is also part of Highland Capital’s summer incubator and the MassChallenge accelerator..)

Co-founders Brett Lewis and Raj Jeyakumar have worked as consultants themselves – Lewis, for example, spent nearly three years at Bain & Company. They’re both recent graduates of Wharton Business School, and they said that when they were students, they wanted to use their experience for freelance work. However, they discovered that it was incredibly difficult to actually find interested companies, so they created Skillbridge to match qualified workers with businesses looking for professional services.

Lewis outlined the vision in a post for the Wharton Entrepreneurship Blog, where he said that the United States’ freelancers have grown from 6 percent of the total workforce in 1990 to 20 to 30 percent now: “Elance, an early talent marketplace, has focused on low-end providers of technology and creative talent. Yet the biggest growth trends are in areas of financial planning and analysis, accounting and legal strategy, where only behemoth white-shoe firms have dominated until now.”

Lewis and Jeyakumar said their core talent base consists of stay-at-home parents and graduate students who have either an MBA or at least three years of experience at a finance or consulting firm. These are people who either aren’t in a position to work full-time or aren’t interested, but they are willing to take on smaller projects or part-time work with flexible hours. And by hiring these workers, companies don’t have to pay for the overhead of a traditional consulting firm.

Not that Skillbridge is trying to replace the big firms. Jeyakumar compared them to Ferraris: “There will always be a need for Ferraris, but there are people for whom a BMW is just fine.” If the BMW doesn’t seem like much of a compromise, that’s Jeyakumar’s point. With Skillbridge, companies that probably couldn’t afford to hire a traditional consulting firm can still pay for high-quality work. He added that there’s already been interest in companies ranging from “pre-revenue startups that need help with market sizing for their pitch decks” to large e-commerce organizations.

The company supposedly delivers a “highly curated” experience, where it provides customers with templates for work requests, identifies two or three of the best matches that they can choose from, and helps to create milestones for the project to ensure that things stay on track. It’s currently in beta testing, with plans for a full launch later this year.